Now introducing the latest global obstacle: the (PP) polypropylene resin shortage. And why not?! We saw it first with containers (and are still dealing with it, somehow) and, looking back, we probably should have seen this resin shortage coming as the root causes for both shortages appear to be more alike than they are different.

As we have learned, the container shortage was created when carriers grounded a sizeable percentage of their fleet in the initial stages of the pandemic, unsure of how consumer spending (and thus exports and imports) would be impacted by the various levels of lockdowns that were occurring around the world. Unexpectedly, spending bounced back almost immediately and has not let up since, which has driven demand and kept supply low and has led to 40’ ocean container rates that are now far beyond historical highs.

What we are seeing with the resin shortage seems to be driven both by an increased demand for polypropylene as well as reduced production at key polypropylene resin manufacturing facilities around the world due to the pandemic, and, additionally in Texas and Louisiana, the recent winter weather.

Polypropylene Resin

Polypropylene is a raw material input used in the manufacturing of everything from clothing to packaging and so it is no surprise that demand has been so high with the increase in consumer spending. Indian manufacturers first became aware of this shortage in early February at a time when Chinese manufacturers were not so worried, though prices are now on the rise not only in all of Asia, but in Europe and the western hemisphere as well.

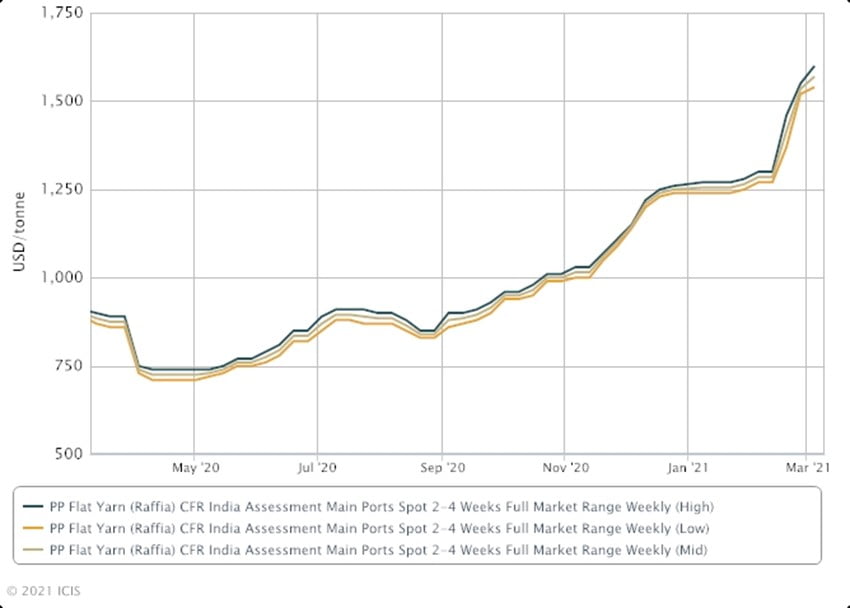

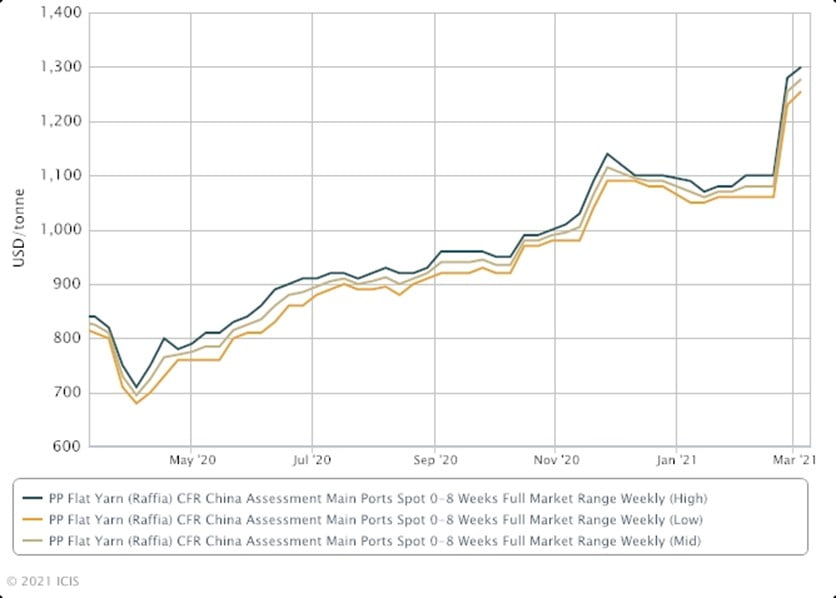

February saw the largest single month PP resin increase of all time, according to Plastics Today, and many analysts believe that we could still be nowhere near the ceiling and potentially months away from prices beginning to make their return to normal levels. As of March 5th, ICIS had resin prices out of India listed at $1,600/MT (metric ton), though Indian manufacturers that were lucky enough to procure resin have paid anywhere from $1,550-$1,800/MT for resin stock that often times went right into production due to uncomfortably low levels of inventory upon arrival. The graphs below highlight the swift increases seen throughout Asia.

India Polypropylene Resin - USD/MT as of 3/5

China Polypropylene Resin – USD/MT as of 3/5

As we fully expect this situation to change week to week, we have asked for our customers to consider our plastic packaging quotes to be valid for a period of 7 days so that we can ensure that we are providing the most accurate costing and lead time information in order to provide a smooth inventory planning process for both parties. As a small to medium-sized company, we understand the impact that significant cost increases can have on both the top and bottom line and so our goal is to offset this increase as much as possible where we can. Our aim is and has always been to provide packaging products of the utmost quality and at competitive prices, with the ultimate goal of securing the valuable supply chain of all of our customers at any cost; we promise to do whatever it takes to ensure that this never changes. We are grateful for the understanding and continued support of our customers and we look forward to coming out of the other side of this together. Stronger.

For more information on the Global Polypropylene Resin Shortage, please check out similar news articles like these: